Step#5: After that, sign your name in the ‘Employee’s Signature’ section. Report the name that you are authorizing to make deposits to your account. Step#4: Enter your company name on the given blank line. And, you also have to attach the voided check for each account.

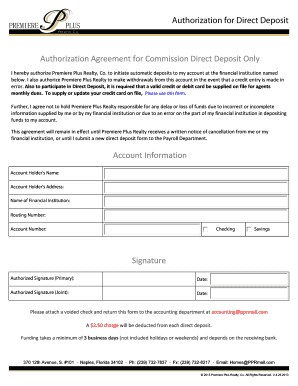

Step#3: Then, choose the type of account that you would like the deposit to be made. Enter it on the given blank line labeled ‘9-digit routing#’. After that, find the 9-digit routing number on your personal check. Enter your account number on the given labeled line. Step#2: Next, report the name of your bank on the first line. Step#1: At first, you have to complete the Account Holder’s name and address. Here are some steps how to fill in a direct deposit form How do you fill in a direct deposit form?

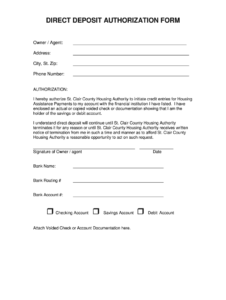

So, they used it to keep the record of the employees who have given them authorization for direct deposit. It is under the payroll department of a company. This form is used for the employee’s paycheck to be deposited directly into his account. It is similar to the employee direct deposit form.

You may also see the Salary Slip Format in Excel. Furthermore, this form also includes options such as to authorize, revise, or cancel direct deposit to the account. It gives the employer the authority to direct deposits to his account. This form has to be filled by an employee of the company. In addition, it allows you to deposit payments for your monthly bills and obligations from your account. This type of form is most common and used to set-up your accounts to receive deposits. So, let us discuss the most common types of direct deposit form. You have to decide the template of the direct deposit form before asking about the form from your employer or a bank.

0 kommentar(er)

0 kommentar(er)